While most tax payers don’t particularly look forward to tax season, for some scammers it’s like the opening of their hunting season. So it’s no surprise that our researchers have found yet another tax-related scam.

In this most recent scam, we’ve not seen the lure the scammer uses, but it is likely to be an email telling the target to quickly go to this site to apply for your IRS EIN/Federal tax ID number.

EIN is short for Employer Identification Number. The IRS uses this number to identify taxpayers who are required to file various business tax returns. EINs are used by employers, sole proprietors, corporations, partnerships, non-profit associations, trusts, estates of decendents, government agencies, certain individuals, and other business entities.

Given the flow of the scam it’s very likely that the targets are self-employed and/or small business (SMB) owners. It’s possible that the phisher has obtained or bought a collection of email addresses from a data broker that fit a certain profile (for example, self-employed US residents).

To start this operation, the scammer doesn’t need a lot of information about their targets. A valid email address for a self-employed US resident could cost just a few cents on an underground forum on the dark web. However, the scammer might not even need to venture that far, as Senior Director of Technology and Engineering and Consumer Privacy at Malwarebytes, Shahak Shalev told us:

“I don’t think one would have to go to the dark web to get information like this as there are regular companies selling this information. They would probably qualify it as “lead generation”. According to our sources, pricing for one million self-employed US citizens usually goes for $1USD per contact, but for such a large amount it would probably be $0.1 per contact.”

The information the phishers are after is quite extensive and includes a person’s social security number (SSN).

A compromised social security number poses a major problem. A SSN stays with you for a lifetime, and is closely tied to your banking and credit history. Adding a person’s SSN to the scammers’ data could create far more opportunities for identity theft and fraud.

And if that wasn’t serious enough, the scammers here have the audacity to charge you for the tax ID number, even though applying for an Employer Identification Number (EIN) is a free service offered by the Internal Revenue Service (IRS).

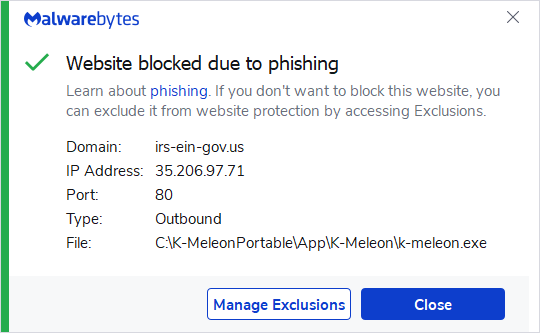

We also found the scammer made a mistake when setting up their fake website. By looking at the privacy policy of the scammer’s site it became apparent that they forgot a small edit when they copied the privacy policy from someone else, but neglected to edit the original domain in one place.

If you’ve received a mail or other invitation including a link to the domain irs-ein-gov.us, please let us know in the comments. We would love to have a copy so we can complete this attack profile.

How to avoid falling for a tax scam

Before acting on an email’s request, stop and think about the following:

- Remember: The IRS doesn’t ask taxpayers for personal or financial information over email, text messages, or social media channels. This includes requests for PINs, passwords or similar access information for credit cards, banks, or other financial accounts.

- Do not interact with the sender, click any links, or open any attachments.

- Send the full email headers or forward the email as-is to phishing@irs.gov. Do not forward screenshots or scanned images of emails because this removes valuable information.

- Delete the email.

If you are unsure if a certain communication is from the IRS, you can go to IRS.gov and search for the letter, notice, or form number. If it is legitimate, you’ll find instructions on how to respond. If there’s a form to fill in the verify that it is identical to the same form on IRS.gov by searching forms and instructions.

Malwarebytes Premium customers are protected against this particular scam if they have Web Protection enabled.

IOCs

Domains

ustaxnumber[.]org

ustaxnumber[.]com

irs-ein-gov[.]us

Check your digital footprint

If you want to find out how much of your data has been exposed online, you can try our free Digital Footprint scan. Fill in the email address you’re curious about (it’s best to submit the one you most frequently use) and we’ll send you a free report.

We don’t just report on threats—we help safeguard your entire digital identity

Cybersecurity risks should never spread beyond a headline. Protect your, and your family’s, personal information by using identity protection.