What you need to know:

- This WhatsApp scam begins when someone persuades you to share your screen so they can “help” with a payment issue or account update.

- The caller usually pretends to be from your bank or a company’s support team. They use urgency to try to make you act fast or panic.

- Once screen sharing starts, they can see everything on your phone. This includes text messages and one-time passwords.

- Some scammers follow up by sending links to remote-access tools such as AnyDesk or TeamViewer, claiming they’ll “fix” the issue. These apps can actually give them full and ongoing control of your device.

- The best defense is awareness. Know the red flags and learn how to spot fake support calls. Follow recovery steps quickly if you think you’ve been tricked.

If this has already happened, stop sharing right away and turn off your internet connection. Then contact your bank’s fraud department.

What is this scam on WhatsApp all about?

WhatsApp screen mirroring fraud (sometimes called screen sharing fraud) is a social engineering scam. Criminals trick people into sharing their phone screens during a WhatsApp chat or video call. WhatsApp scammers may convince victims under the guise of verifying information or fixing an account problem. People who fall for it potentially give up a front-row view of everything happening on the device. This can have serious security implications.

How does this fraud actually work?

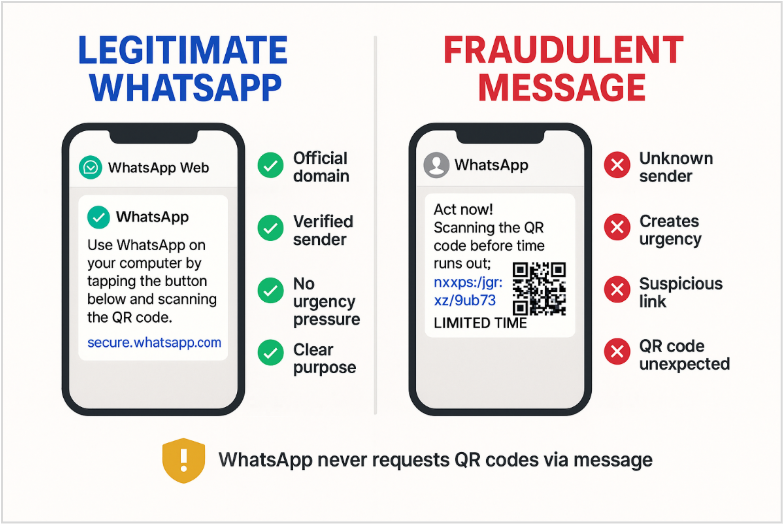

The scam usually starts with a call or message that looks routine. Scammers on WhatsApp might pose as a representative from a bank or customer service line, saying there’s an issue with your account or transaction. They ask you to tap WhatsApp’s “Share Screen” option.

This feature doesn’t give remote control. It does give the other person a live feed of your screen. As you open your banking app and type in your PIN or receive an OTP, the scammer records every detail. They can then use this information to access your accounts or make unauthorized transfers. This is a scam that can unfold within minutes.

Why do fraudsters use WhatsApp for this?

WhatsApp has become the go-to messaging service. It’s where we chat with friends and sometimes interact with businesses, or receive official notifications.

Fraudsters take advantage of that familiarity. They often impersonate banks or company support and use official-sounding language to appear legitimate.

You might get messages claiming:

- “We need to verify your details before your account is locked.”

- “This is a security check for your recent transaction.”

- “Please share your screen so we can update your account or confirm your refund.”

You should treat messages like this with suspicion.

How do fraudsters trick people on WhatsApp?

Most WhatsApp screen mirroring scams roughly follow the same pattern. Understanding the flow makes it much easier to spot the trap before it closes.

- Fake message or call: Scams on WhatsApp usually begin with a WhatsApp message or voice call from someone pretending to be from customer support or an official company or organization. They may use an official logo or even a familiar name to look trustworthy.

- Building trust and urgency: They try to make you act fast. You’ll hear phrases like “your account will be locked soon” or “you must verify immediately.” This combination of authority and pressure is designed to make you stop thinking critically.

- The “Share Screen” request: They’ll ask you to tap “Share Screen” in the WhatsApp call. They claim it’s to help fix an error or confirm your details. Instead, it actually gives them a live view of your phone.

- Watching your private information: As you type passwords or receive OTPs, they watch and record everything. Some even screenshot or screen-record the session for later use.

The information scammers see may be enough to drain accounts or steal your identity.

What can happen if you fall for WhatsApp screen mirroring fraud?

What happens depends on what is shared while your screen is mirrored. WhatsApp scammers are looking for private information. They may also be able to use personal chats and private photos. The main threat is that they can log into your accounts. But they may also impersonate you in new scams.

The most common outcomes include:

- Financial theft: unauthorized transfers or credit card misuse.

- Account takeovers: losing access to email or social media.

- Identity fraud: scammers using your details to open new accounts.

The deception can sometimes go further. After the first call, fraudsters may send links to external apps like AnyDesk or TeamViewer and claim they’re needed to “complete verification.” Installing these gives them deeper access.

A fast response can still protect you. Ending the session and calling your bank’s fraud helpline can limit the harm and sometimes stop losses before they spread.

What are the red flags of WhatsApp screen mirroring fraud?

Scammers rely on catching you out. There are some warning signs that are consistent once you know them. If you see any of these, it’s time to stop and verify:

- Calls or messages claiming to be from your bank or support center. Would they contact you via WhatsApp?

- Unexpected requests to tap “Share Screen” during a WhatsApp call.

- Urgent phrases like “Your account will be blocked in X minutes.”

- Instructions to enter an OTP or password while still on a call.

What to do instead:

Verify the caller’s identity through your bank’s official helpline or app. Never go through WhatsApp. Real companies don’t ask for screen sharing or OTPs, especially not over chat. If you feel pressured, hang up. Urgency is their favorite weapon. You can always contact the company through the correct means.

What should you do if you already shared your screen on WhatsApp?

Time matters. Acting quickly can stop a WhatsApp screen share scam before it causes serious damage.

What’s the first thing to do right now?

The very first steps to take are:

- Disconnect your device from Wi-Fi or mobile data immediately to cut off access.

- Run a full antivirus or mobile security scan. Malwarebytes Mobile Security can help detect threats and allow you to tackle them at the earliest opportunity.

- Change your passwords from a different, clean device. Do not use the compromised one.

- Call your bank’s fraud department as soon as possible to freeze suspicious activity.

How can you report and recover from the fraud?

Always report what happened to prevent the same thing happening to others. Many people have come forward after suffering losses from a screen mirroring scam to help raise awareness.

Start by contacting your bank (if your account is compromised) through the official channels.

The next step is to contact your local cybercrime authority.

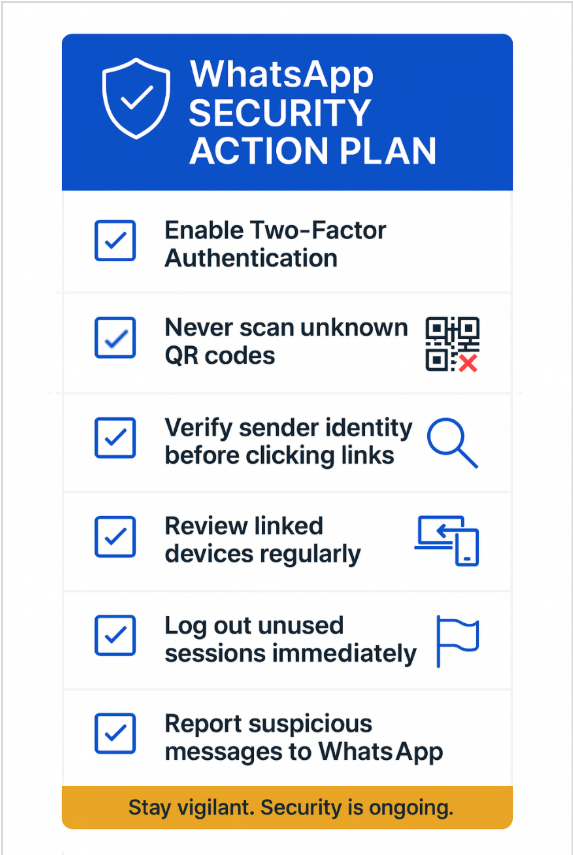

Keep screenshots and chat logs as evidence. They help investigators trace patterns and improve fraud prevention. You can use WhatsApp’s in-app reporting feature to flag the fraudulent account. The site also has a “Block unknown account messages” feature. This allows people to stop unsolicited messages as an extra layer of security.

Early reporting increases the chances of catching the fraudster and helps authorities identify repeat offenders. It may also help your chances of recovering funds that have been lost.

How can you protect yourself from future WhatsApp fraud attempts?

Fraud prevention is mostly about habits. A few small steps can keep your accounts secure and your information private.

What preventive steps really work?

- Keep WhatsApp and all apps updated and only install them from official stores like Google Play or the App Store.

- Enable two-factor authentication (2FA) on WhatsApp and all financial or email accounts to add an extra layer of protection.

- Review app permissions regularly and disable “install from unknown sources” on Android devices.

- Talk about these scams with friends and family. You may want to warn older relatives who may be more likely to trust unknown callers.

Staying alert is your best defence from these forms of fraud. Screen mirroring is a feature that you will probably use rarely. Never do it with a number you don’t know or trust. WhatsApp has said it will provide a warning to users that attempt to start screen sharing with an unknown contact.

Is screen sharing ever safe on WhatsApp?

Screen sharing can be safe only with people you personally know and trust. Perhaps during family or work calls. Even then you need to verify their identity and avoid opening banking apps or entering any passwords while your screen is visible.

If the other person starts behaving oddly or asks for private details, stop sharing immediately and close the session.

Related articles:

What makes online scams so difficult to identify?

What are social engineering tactics used in WhatsApp scams?

Could WhatsApp scams indicate a hacked phone?